Replying to here’s the layout for mt 2023 monthly budget + spending tracker template! available in my stan :) let me know in the comments what tools help you budget and track your spending every month? #personalfinancetok #personalfinance101 #personalfinancetips #genzfinance #moneytomiles #moneytok #genzfinancetips #genzfinanceinfluencer #budgeting #howtobudget #budgettemplate #monthlybudget #spendinghabits #spendingtrackerġ1.3K Likes, 198 Comments. Sure Thing Sped up Version - Stoci.Ģ9.3K views| Sure Thing Sped up Version - Stoci It has sheets for a gift list, holiday budget, holiday tasks, dinner planning, and many other holiday essentials.

BUDGET PLANNER EXCEL FOR FREE

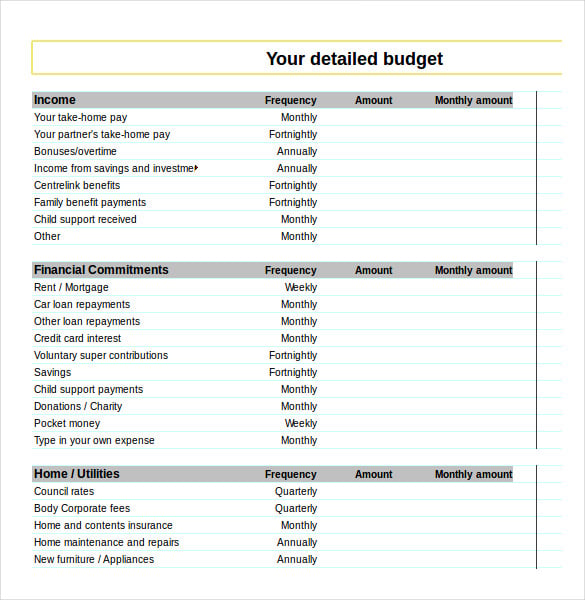

HOW TO MAKE A FORMULATEDīUDGET ON EXCEL | Part one | You can download this template for free on my website |. Customize a monthly budget template in Excel (1) Calculate total income per month: In Cell B7 enter SUM(B4:B6), then drag the Fill Handle to apply this. This Excel Holiday planner will help you stay organized.

BUDGET PLANNER EXCEL SERIES

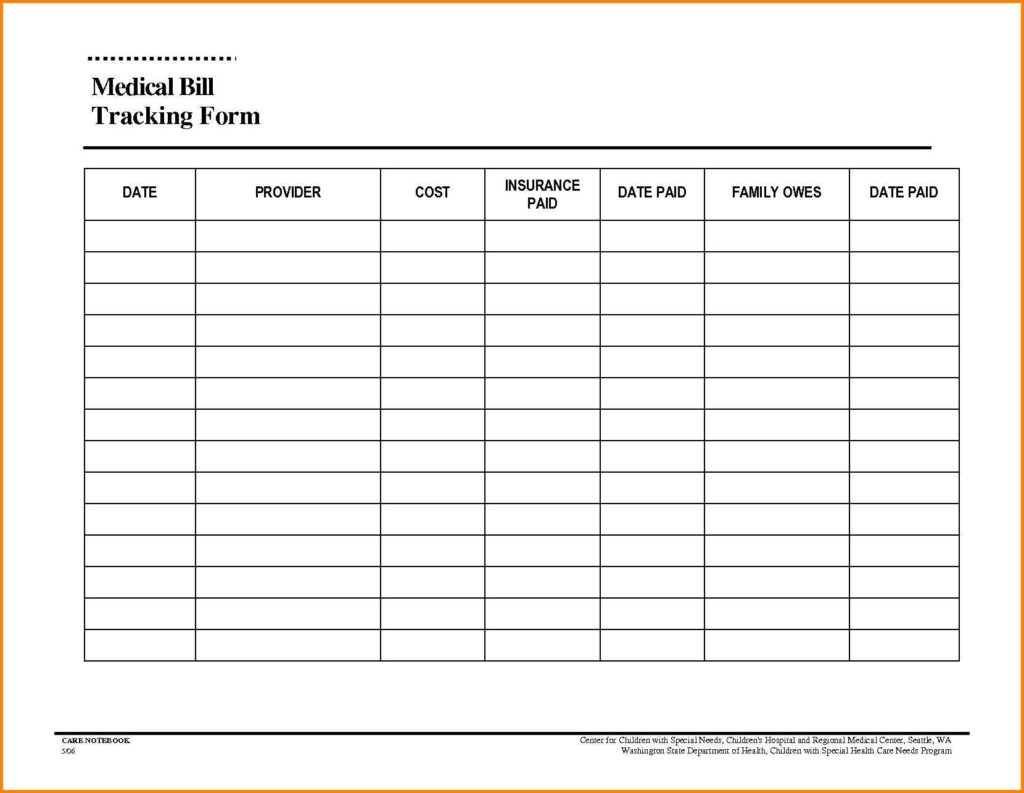

The Total Paid row at the bottom will sum the amounts that are checked.How to make a formulated excel spreadsheet in order to make yourself a budget! I recently shared our budget (which you can download for free on my website) and was surprised at how many people didn’t know how to use a spreadsheet so I thought it would be super useful to do a series of videos to explain the basics of using an excel spreadsheet! I find they’re a perfect tool to help you take control of your finances so want to share the knowledge I have with you all🤍 follow for part two! #excelspreadsheet #howtomakeaspread #spreadsheet #spreadsheettutorial #spreadsheetformatting #budgetingmum #howtomakeabudget #budgeting #fyp #foryoupage #personalfinance how to make a spreadsheet how to use an excel spreadsheet how to budget how to make a budgetĤ76 Likes, TikTok video from THE BUDGETING MUM💰 "How to make a formulated excel spreadsheet in order to make yourself a budget! I recently shared our budget (which you can download for free on my website) and was surprised at how many people didn’t know how to use a spreadsheet so I thought it would be super useful to do a series of videos to explain the basics of using an excel spreadsheet! I find they’re a perfect tool to help you take control of your finances so want to share the knowledge I have with you all🤍 follow for part two! #excelspreadsheet #howtomakeaspread #spreadsheet #spreadsheettutorial #spreadsheetformatting #budgetingmum #howtomakeabudget #budgeting #fyp #foryoupage #personalfinance how to make a spreadsheet how to use an excel spreadsheet how to budget how to make a budget". If you prefer to continue editing the spreadsheet on your computer, you can use the drop-down in the checkbox columns to check off when a bill is paid. You can allocate a budget for a week or bi-week, and record the actual amount.

BUDGET PLANNER EXCEL UPDATE

If a payment is variable, you can enter the average amount at first, and then update it with the actual amount after you get the bill.įinally, you can print a copy of the worksheet if you want to include it in your planner or display it somewhere as a reminder. Our Weekly Budget Template is created to help you in allocating a budget for a single week or a bi-week for various expenses at the start of the week and then calculates the difference at the end of the week or even at the end of the month. Next, enter the expected amounts for the bills for each month. The Day column is just for your own reference.

In the Day column, you can list the day of the month that the bill is typically due, such as 1st, 15th, EOM (for end-of-month), etc.

I would recommend listing them in order of priority, with the most critical bills to pay at the top. How to Use the Bill Tracker Worksheetįirst, list all your expected bills. You may not need this if you are already using the money management spreadsheet, but if you like to manage your budget by hand, this worksheet can be a very useful tool to include in your budget planner. You can use this bill tracking spreadsheet to list all your recurring bills with their expected payment amounts, and then check them off when they are paid.

0 kommentar(er)

0 kommentar(er)